It was a moment that encapsulated hubris and folly – President George Bush proudly declaring

“mission accomplished”

in 2003, only for the Iraq war to drag on, fueling global terrorism and Middle East turmoil. The echoes of that misguided optimism are still felt today.

The Reserve Bank of Australia (RBA) faces a different kind of challenge – navigating the choppy waters of economic uncertainty with prudence and foresight. As Governor Michele Bullock prepares to address the nation, there is no grandiose banner proclaiming victory. Instead, there is measured consideration of falling inflation rates, a resilient job market, and an expanding economy.

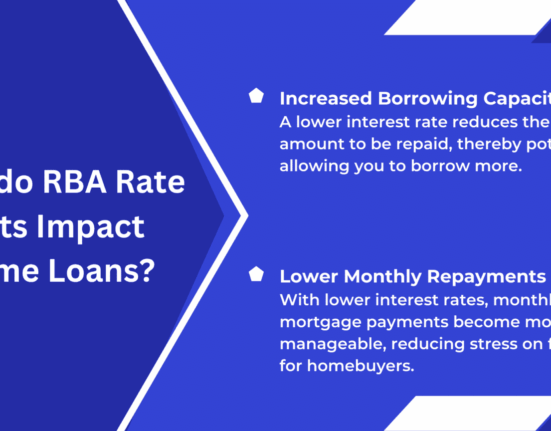

Most experts anticipate another interest rate cut as the RBA seeks to stimulate growth without waiting for a crisis to unfold. This proactive approach contrasts sharply with past policies that led to severe recessions in Australia’s history. The delicate balance between curbing inflation and sustaining employment has been historically elusive but seems more attainable now.

Despite criticism from various quarters, including calls for higher interest rates or concerns about damaging the economy, the RBA’s strategy has so far kept unemployment stable while adding over a million jobs since rate hikes began. The dual mandate of controlling inflation and maximizing employment seems within reach amid global uncertainties like conflicts in Ukraine and the Middle East.

In stark contrast stands the United States where President Trump wages open warfare against Federal Reserve Chair Jerome Powell over interest rates. Trump’s recent outburst urging significant rate cuts exposes his misunderstanding of economic fundamentals, as reflected in comparisons with obscure nations’ interest rates rather than addressing America’s unique financial challenges.

The US confronts soaring deficits and debt levels amplified by massive spending bills that could strain its fiscal sustainability. In contrast, Australia appears better positioned under Bullock’s guidance as she steers policy adjustments to support households still reeling from pandemic impacts while bracing for external shocks like those emanating from Washington DC.

While Powell emphasizes the need for prudent fiscal management to avoid long-term financial woes, Trump’s push for aggressive rate cuts reflects short-term thinking at odds with sustainable economic practices. The divergence between these approaches underscores the critical role central banks play in maintaining stability amidst turbulent political landscapes.

As Bullock contemplates another rate cut to bolster Australia’s economic resilience, her actions stand as a testament to prudent policymaking in volatile times. While Trump engages in high-stakes battles over interest rates on the world stage, Bullock quietly maneuvers through domestic challenges with a steady hand and cautious optimism.

In this saga of contrasting leadership styles – one marked by bluster and bravado, the other by pragmatism and poise – lies a tale of two economies navigating uncertain terrain. As financial storms gather on the horizon, it remains to be seen whose approach will weather the impending turbulence more effectively – Trump’s erratic maneuvers or Bullock’s measured strategies aimed at ensuring Australia’s economic stability.

Leave feedback about this