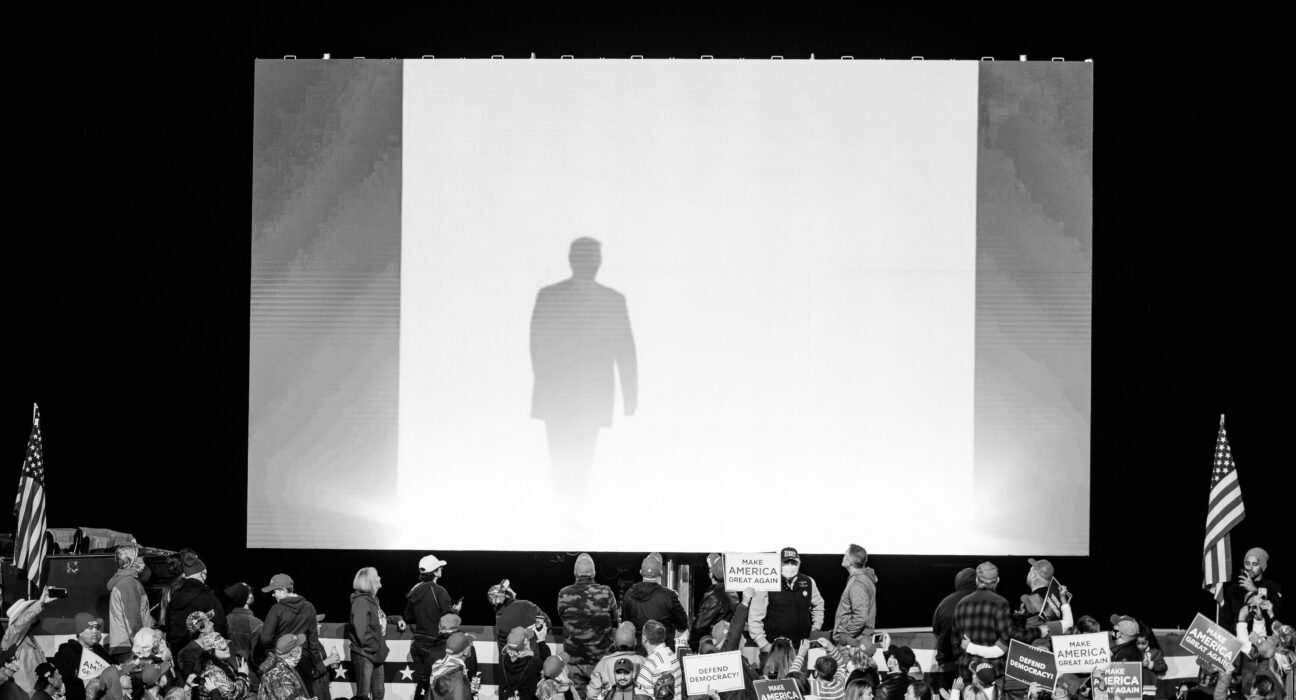

We are about to find out the cost of the Trump chaos. Donald Trump’s presidency has been marked by bold declarations and unpredictable policy shifts, especially in economic matters. From calling for significant interest rate cuts to implementing tariffs on various goods, his actions have stirred up a storm of uncertainty.

Trump’s treasury secretary lauded the administration’s policies for the positive inflation data, but experts warn against premature celebrations. The Federal Reserve Board is unlikely to heed Trump’s calls for drastic rate cuts. As the chaos unfolds, economists speculate about its impending impact on economic indicators.

The recent inflation numbers showed a slight uptick, defying expectations of a more significant increase fueled by Trump’s tariffs. While some anticipated a surge in prices due to trade tensions, the actual impact seems subdued. The implementation of tariffs has been erratic, with delays and amendments creating confusion among importers.

Despite initial concerns about tariff-related price hikes, consumer-facing companies are biding their time before passing on costs to customers. This cautious approach reflects a wait-and-see attitude prevalent in the business community. Companies are wary of making abrupt decisions amidst the ongoing tariff uncertainties.

The looming question remains: how will these tariffs affect the broader economy? Analysts predict that the true repercussions may unfold gradually over the coming months. Data from various sectors will shed light on how businesses navigate these new challenges and whether consumers bear the brunt of price increases.

While some sectors like major appliances have already seen price spikes linked to tariffs, others such as new cars have experienced declines due to global market factors. The complex interplay between tariff impacts and market dynamics adds layers of complexity to predicting future economic trends.

The Federal Reserve faces a delicate balancing act in managing both inflationary pressures and economic growth amidst trade uncertainties. The central bank’s cautious approach reflects concerns about potential stagflation—an undesirable scenario of low growth coupled with high inflation—triggered by tariff disruptions.

Trump’s persistent calls for lower interest rates reveal his eagerness to stimulate economic activity, even at the risk of undermining monetary policy credibility. His push for aggressive rate cuts contrasts sharply with Fed Chair Jerome Powell’s measured stance on monetary adjustments.

As political tensions escalate over fiscal policies and debt management, investors closely monitor developments that could sway market confidence. The intricate dance between policymakers, economic indicators, and international trade dynamics sets the stage for a volatile period ahead.

In this climate of uncertainty and conflicting interests, expert analysis points towards a challenging road ahead for US economic stability. Navigating through turbulent waters requires prudent decision-making and strategic foresight to mitigate risks associated with geopolitical turmoil and policy volatility.

The unfolding saga of Trump’s economic legacy underscores the intricate web of factors shaping global markets and investor sentiment. As events continue to unfold, observers brace themselves for further twists and turns in this riveting narrative of power struggles and financial brinkmanship within governmental corridors.