Starting a new business can be an exciting journey, but securing funding is often a crucial step in turning your idea into a reality. For many entrepreneurs, venture capital (VC) investors represent a significant source of financial support and expertise. But how can you determine if your startup idea is attractive to these potential backers?

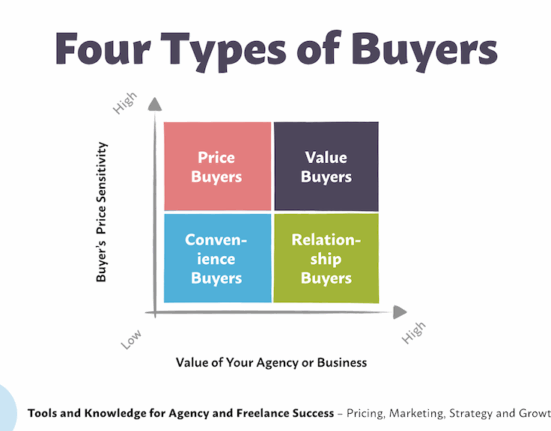

Venture capitalists are constantly on the lookout for innovative ideas with the potential for high returns. To capture their attention, your startup concept needs to stand out from the crowd and demonstrate strong growth prospects. One key aspect that VCs consider is the problem your product or service solves and whether there is a sizable market demand for it.

According to industry experts,

“VC investors are looking for startups that address pressing issues in unique ways.”

By focusing on solving a real-world problem effectively, you increase your chances of attracting VC interest. Conducting thorough market research to validate the need for your solution can provide compelling evidence to investors that your idea has merit.

In addition to addressing an existing problem, VCs also assess the scalability of your business model. Scalability refers to the ability of a company to handle growth without compromising its operations or increasing costs proportionally. Demonstrating how your startup can scale efficiently and capture a larger market share over time is essential in piquing investor curiosity.

An experienced entrepreneur advises,

“Show VCs that your startup has the potential to grow rapidly and generate substantial profits.”

Highlighting factors such as recurring revenue streams, competitive advantage, and expansion opportunities can help paint a clear picture of long-term success in the eyes of investors.

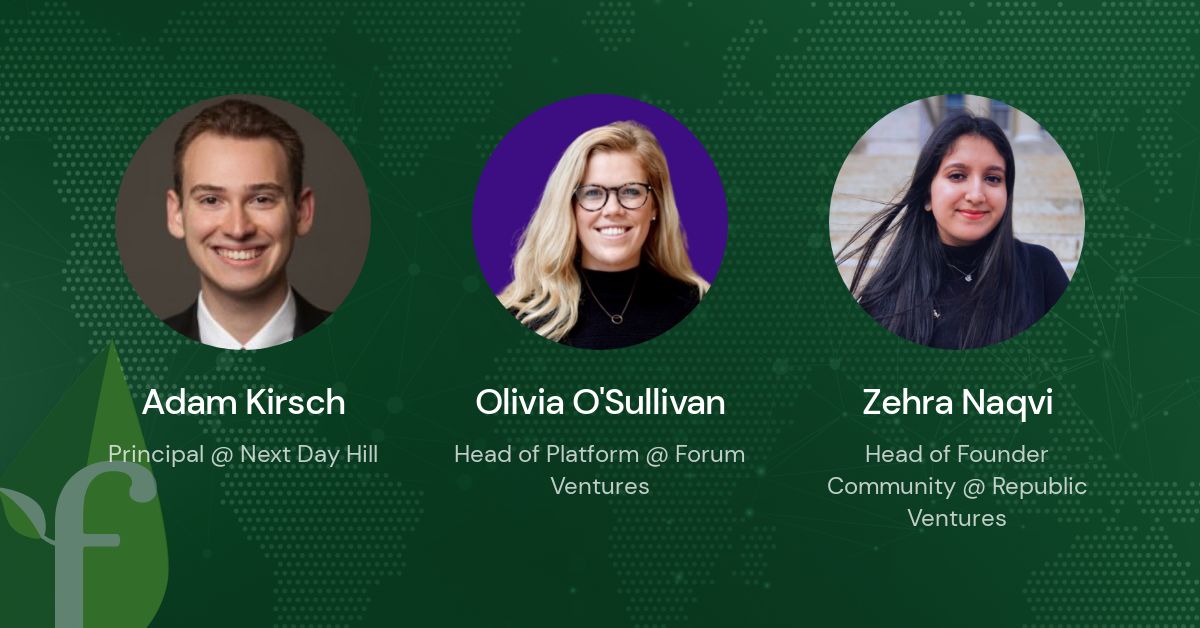

Moreover, building a strong team with diverse skill sets is crucial when presenting your startup idea to VCs. Investors not only evaluate the viability of your business concept but also consider the capabilities of the founding team in executing that vision. A well-rounded team with complementary skills showcases resilience and adaptability, qualities highly valued by venture capitalists.

When pitching your startup idea to investors, it’s essential to craft a compelling narrative that articulates why your solution is unique and why you are best positioned to bring it to market successfully. Creating a persuasive story around your product or service can captivate VCs’ interest and differentiate you from other entrepreneurs seeking funding.

Remember – establishing credibility through milestones achieved, such as early customer traction or partnerships secured, strengthens your case before potential investors. These achievements serve as tangible proof points that validate both the demand for your offering and your team’s ability to execute on its vision effectively.

In conclusion, attracting VC investment requires more than just having a good idea; it demands thorough preparation, strategic planning, and effective communication skills. By understanding what venture capitalists look for in startups – from addressing critical problems innovatively to demonstrating scalability and assembling a capable team – you can better position yourself for funding success.

So before approaching VC investors with your startup idea, ensure you have ticked all the boxes: solid problem-solving approach, scalable business model, talented team members onboarded – all wrapped up in a compelling storytelling package that convinces them of both opportunity and execution capability!

Leave feedback about this